Thursday February 9

By Tony Dong · Mutual Funds

BLNDX offers an interesting alternative to the 60/40 portfolio moving forward.

What happened in 2022 probably added an additional task to the advisor's repertoire: explaining to an irate client how their "balanced" 60/40 portfolio of stocks and bonds could underperform a 100% equity position. After all, bonds are for safety, right?

For 40 years, this assumption operated brilliantly. As interest rates fell and stayed low, bonds held a consistently negative correlation with equities and could be used to offset risk during bear markets and crashes. Heck, from 2000 – 2009, U.S. aggregate bonds beat the S&P 500 soundly.

The 60/40 portfolio is a product of these times, and it failed to prove its worth in 2022. Whether or not it will shine again in the future is up for debate, but it’s worth noting that many alternative funds that advisors wrote off for high fees and stagnant performance did exceptionally well.

Whether or not adding alternatives like managed futures can help over the long term is debatable, but there is a new trend towards multi-asset funds that incorporate these alternatives into their asset allocation. Here's a notable one that I think is worthy of scrutiny.

The term "all-weather" can be traced back to Ray Dalio, founder of Bridgewater Associates. Simply put, Dalio believed that certain asset classes performed better in different economic scenarios.

According to Dalio, there were four economic "climates": Higher-than-expected inflation, higher-than-expected growth, lower-than-expected inflation, and lower-than-expected growth.

These four climates can interact to form quadrants. For example, a period of lower-than-expected growth coupled with higher-than-expected inflation would qualify as "stagflation".

Retail implementation of Dalio's portfolio centers around four assets: stocks, Treasurys, commodities, and gold. This is similar to Harry Browne's earlier "Permanent Portfolio", which consisted of stocks, Treasurys, cash, and gold.

In recent years though, actively managed hedge-fund like products have started to replace the usual passive commodities exposure, which has some weaknesses like contango. Notable products in this space include managed futures, which I covered in earlier articles here and here.

BLNDX is a prime example of an all-in-one fund which incorporates these considerations. The fund seeks to improve performance by seeking uncorrelated returns and minimizing drawdowns. BLNDX can be separated into three portions:

Morningstar categorizes BLNDX as "Macro Trading", which was one of their new alternative categories introduced in 2021. Advisors wishing to find funds similar to BLNDX can consider looking there.

Like most alternative funds, BLNDX doesn't come cheap. The institutional share class (which requires a $25,000 minimum investment) charges a 1.27% net expense ratio. The investor share class (which requires a $2,500 minimum investment) charges a 1.52% expense ratio.

The gross expense ratios for both share classes would have been 1.94% and 2.19% respectively, had Standpoint not agreed to waive some management fees and reimburse expenses. Personally, I'm happy to see the fund not charge a performance fee as some other ones do.

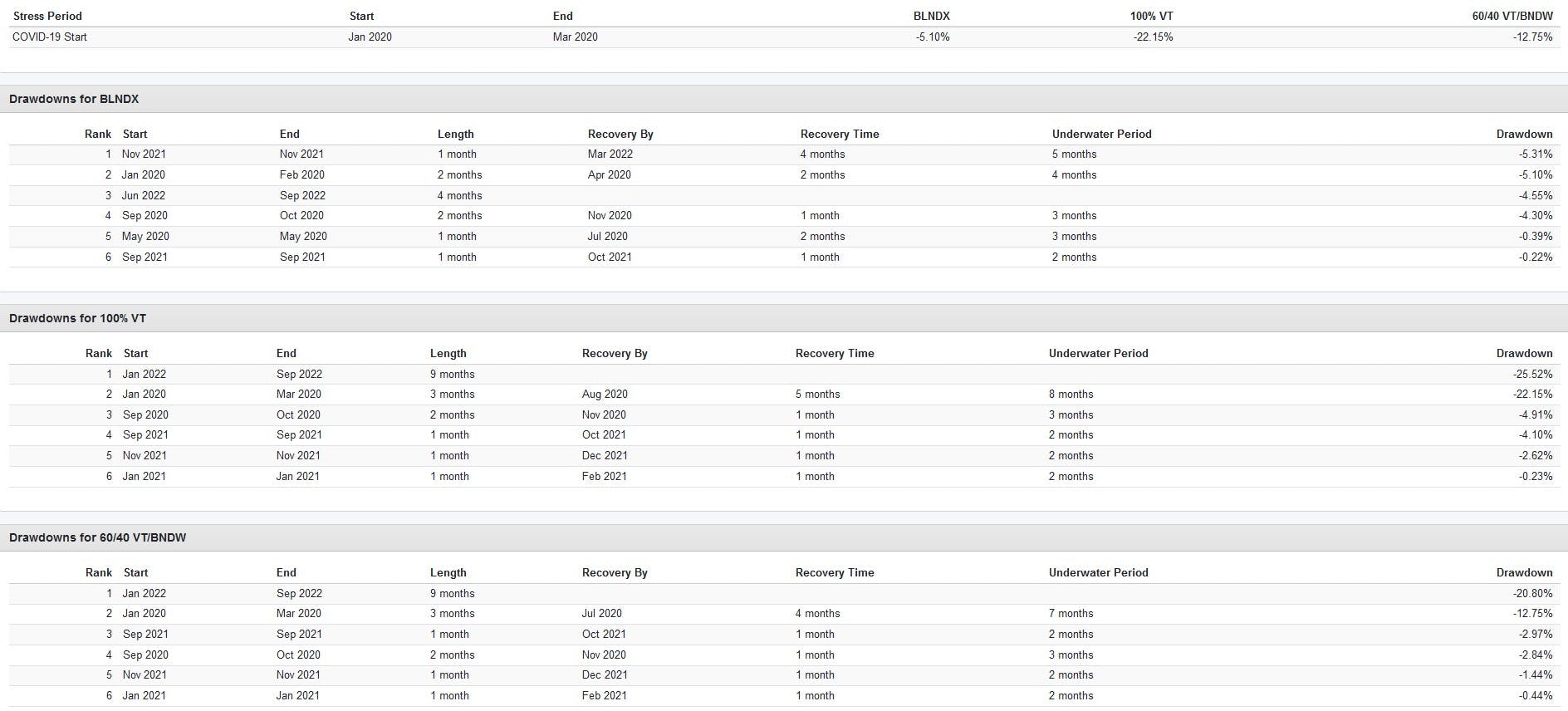

BLNDX made its debut on December 30th, 2019. While this is too short for any sort of meaningful backtest, we can assess how the fund performed during the two recent market crises: the 2020 March COVID-19 Crash, and the 2022 stock and bond bear market.

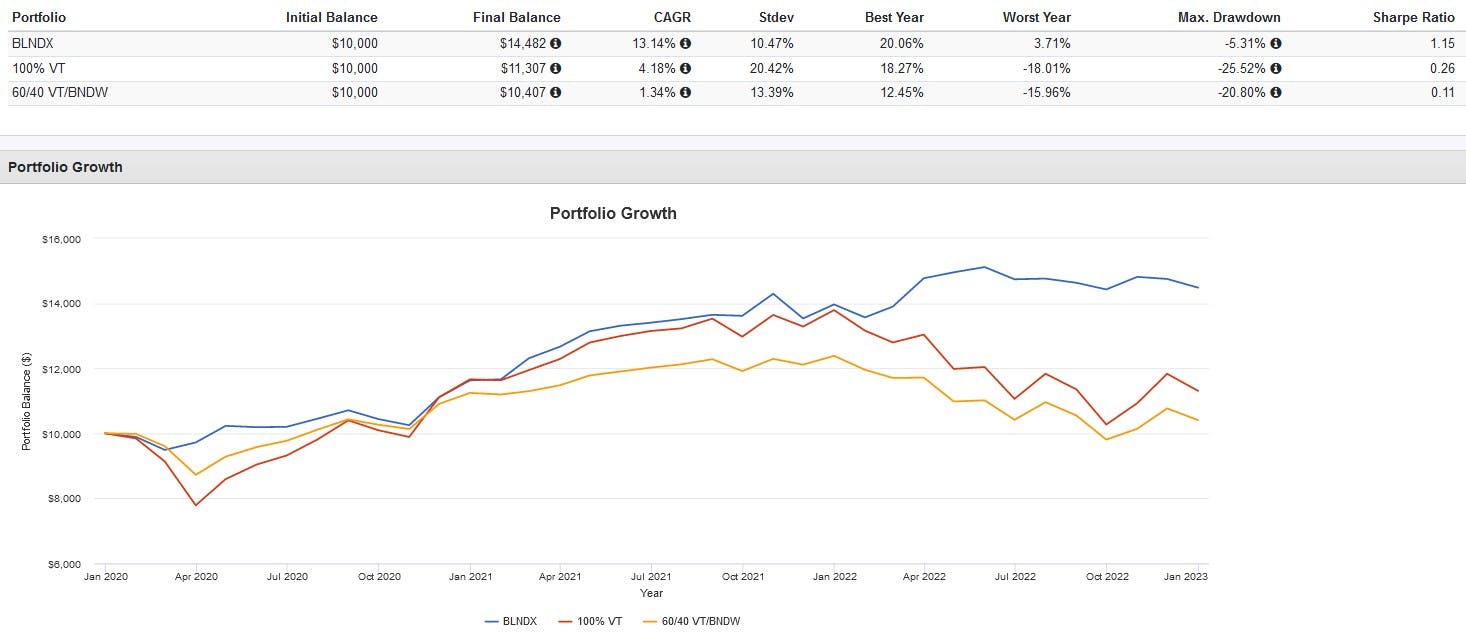

I'll be assessing BLNDX against two portfolios: a 100% global equity portfolio represented by the Vanguard Total World Stock ETF (VT), and a 60/40 portfolio of VT plus the Vanguard Total World Bond ETF (BNDW). These represent common portfolios used by DIY passive investors.

Even after the much higher expense ratios, BLNDX has absolutely delivered on its promises since inception, with lower volatility, drawdowns, and correlation to the market.

I expect it to lag during low-interest rate bull markets like the last decade, but the chance of another decade of double-digit U.S. market returns doesn’t seem particularly plausible now. Of course, the usual caveats with predicting the future and relying on past performance apply here.

That being said, examples like BLNDX should be viewed as a lesson for advisors to keep their minds open and always stay on the lookout for the best opportunities when it comes to their clients.

Please note this article is for information purposes only and does not in any way constitute investment advice. It is essential that you seek advice from a registered financial professional prior to making any investment decision.

Please note this article is for information purposes only and does not in any way constitute investment advice. It is essential that you seek advice from a registered financial professional prior to making any investment decision.

Advertising