Tuesday January 24

By Tony Dong · Investing

Advisors should look beyond authority bias when it comes to the recommendations of famous investing icons.

The "Oracle of Omaha" Warren Buffett is best known for being one of, if not the most, successful investors in history. A student of Benjamin Graham’s style of value investing, Buffett made his fortunes buying the shares of downtrodden large-cap U.S. stocks to beat the S&P 500 handily over many decades.

Apparently, Buffett dabbles in portfolio management and asset allocation too. In his now famous 2013 Berkshire Hathaway (BRK.A/BRK.B) annual shareholder letter, Buffett laid out the guidelines for what he believed to be a sensible investment portfolio:

“My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors.”

Thanks to Buffett’s cult of personality and influence, the internet is now awash with investors seeking to emulate his advice. I mean, why not, right? The man is a billionaire and clearly successful at what he does. The layman should be grateful for Buffett's sage wisdom and endeavor to follow it.

And therein lies the problem: authority bias. Buffett's credentials, accolades, and experience do not necessarily mean his plans for asset allocation are suitable for the majority of retail investors. Advisors, if your clients are hounding you to copy Buffett, consider sending them this article.

Right off the bat, we need to acknowledge that none of us are millionaires. Buffett's advice comes from a position of immense wealth. His estate is huge. So big in fact, that even if the market tanked and never recovered, his wife could live off the income from the short-term Treasurys.

There's also the issue of Buffett's knowledge. The man (and by extension, his wife) is likely immune to the psychological effects of drawdowns. They've been through it before in 1987, 2001, 2008, and now 2020. They have the benefit of understanding the market to a degree few of us ever will.

The average investor has neither of these. Few have the risk tolerance for a 90% equity allocation, let alone one that is concentrated in U.S. large-cap stocks. Few have the same faith and conviction Buffett has when the market takes a bath.

Take a look at this thread from the Bogleheads forum during the height of the 2008 crash. In it, a fairly experienced and knowledgeable retail investor details the anguish of seeing his portfolio drawdown by thousands of dollars as the markets melted down day after day.

Despite the encouragement of other members to stay the course, the member ended up capitulating and selling a portion of his portfolio, moving to money market instruments. This investor wasn't even in a 90/10 allocation – he was likely in a 60/40, or something even more conservative.

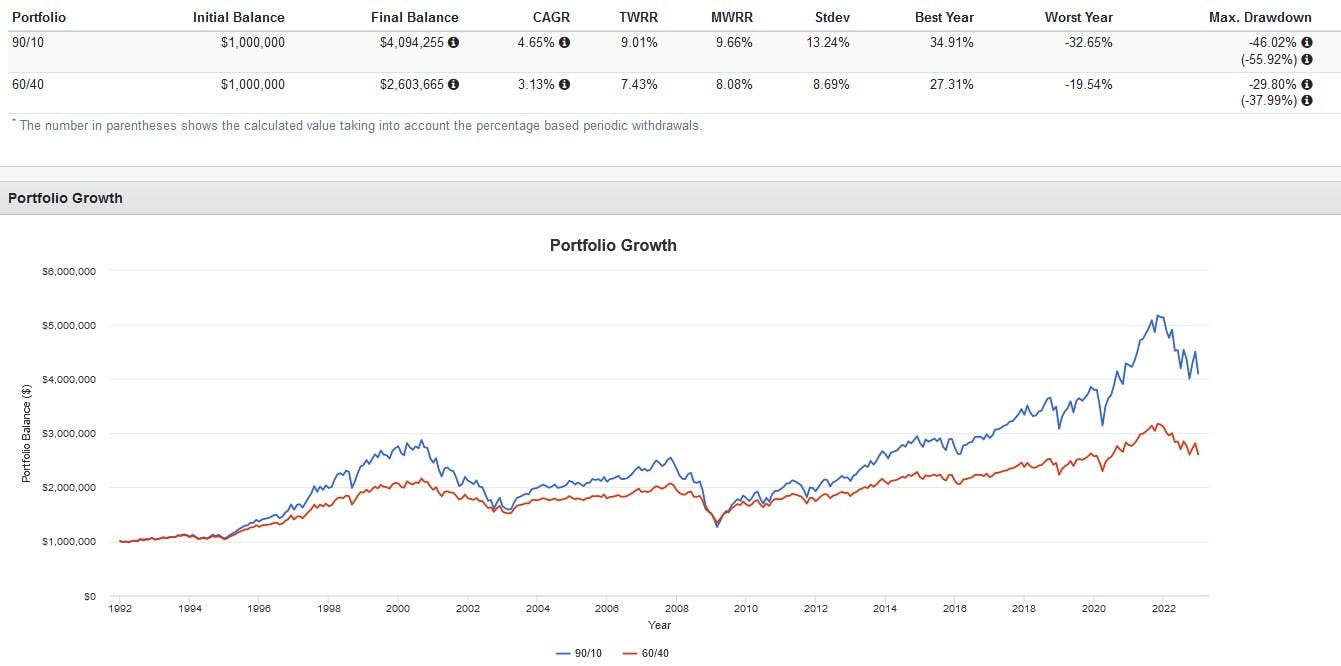

Yes, the 90/10 can survive a 4% withdrawal rate and even does so favorably compared to other allocations. As seen below, it outperformed the 60/40 with 4% withdrawals from 1992 to the present. But it did so with gut-wrenching volatility and drawdowns that were much higher than the 60/40.

I know the S&P 500 is the benchmark for everyone to compete against. It’s the barometer for the overall U.S. stock market. Historically, it's been very hard to beat. Funds tracking it are extremely cheap and have low turnover. It makes for a great all-in-one investment, right?

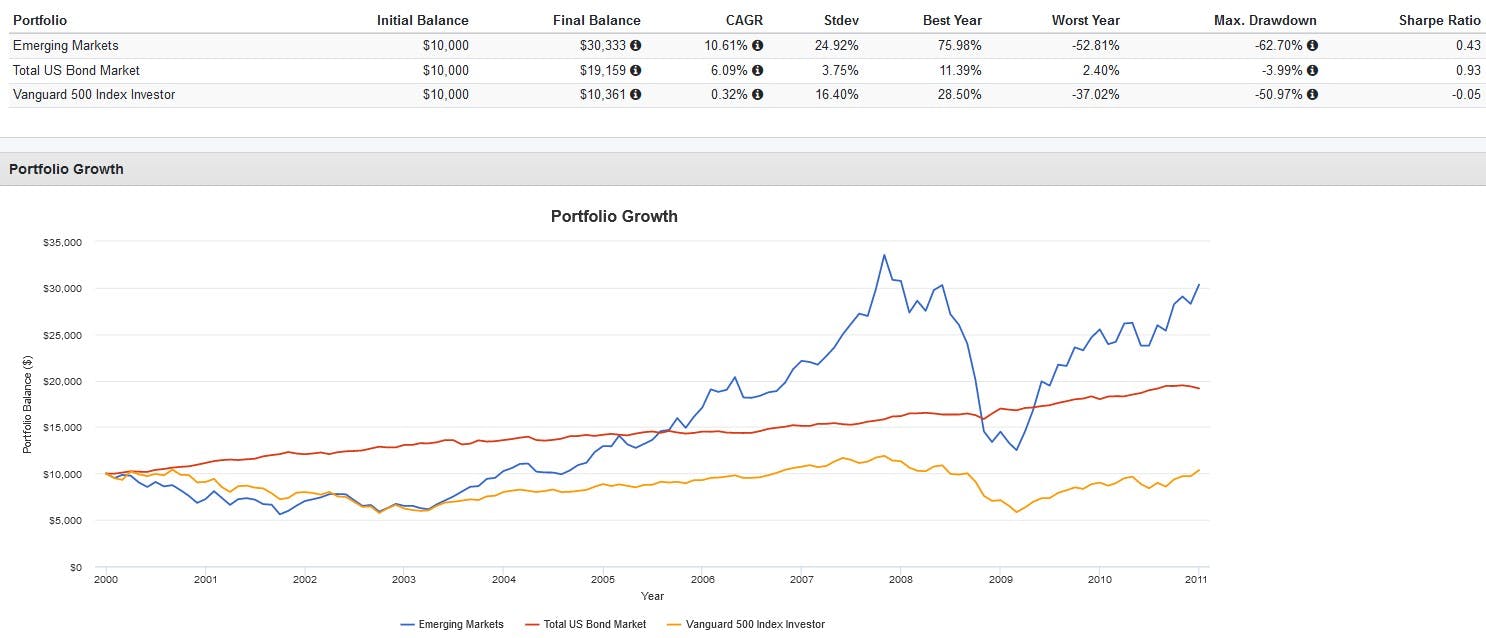

Now, this might sound like cherry-picking, but I want you to imagine explaining to one of your clients between the years of 2000 – 2009 why he or she should stick to their 90/10 portfolio, when emerging markets were returning double-digits year after year and even bonds were beating the S&P 500.

9 years is a long time to put up with flat returns. Buffett is psychologically equipped to handle this – is your client? Or will they lambast you for putting them into a flat returning 90/10 allocation, and demand you overweight emerging markets and bonds in a classic example of the hot hand fallacy?

All of this could have been avoided if your client held a globally diversified portfolio that returned the average of the world's market. Sure, it may never outperform the market, but it won't chronically under-perform it either, which is what is more likely to cause an investor to abandon a strategy halfway.

To sum it all up: yes, Buffett is a genius. Yes, his portfolio strategy is sound, but only for his estate's objectives, risk tolerance, and time horizon. For the majority of retail investors, the 90/10 is a cookie-cutter allocation masquerading as sensible investment advice under the guise of authority bias.

Please note this article is for information purposes only and does not in any way constitute investment advice. It is essential that you seek advice from a registered financial professional prior to making any investment.

Advertising